Brewing Legacies: Cafe Coffee Day's Shot at a Starbucks-style Comeback

Cafe Coffee Day (CCD) used to be the ultimate hangout spot, but the crown jewel founded by the Late coffee mogul V.G. Siddhartha, is now skating on thin ice.

The coffee empire that stole India's heart is dancing on the razor's edge of a roller-coaster ride, but their strategic twists are keeping them from a free-fall.

CCDs' financial, legal and competitor battles are far from over, but they seem to be resurrecting themselves on most of these fronts. Can they defy gravity and reclaim their former glory?

A comparison with their competitor Starbucks elucidates the potential for turnaround. In 2008, Starbucks took a hit that not even its strongest brew could sway. 7 weeks away from the possibility of insolvency, they managed to turn things around and have since generated a remarkable 18x return for their shareholders.

Cafe Coffee Day in a similar fashion has dodged insolvency as of 2024, but its challenges are a bitter concoction. Will they grind out or turn the heat around?

A Lot of Issues Over a Cup of Coffee

It's essential to briefly understand the major causes of Starbucks’ downfall in 2008:

Global economic slowdown reshaped consumer behaviour drastically

New entrants like McDonald's and cost-effective options gained traction

Rapid expansion led to consumer experience plummeting

Poor cash flow management exacerbated the situation

Struggling stores added to tumbling margins

In 2019, the suicide of CCDs’ chairman V.G. Siddhartha kicked the hornet's nest wide open, Coffee Day Enterprise Limited’s (CDEL) books brought to light the breeding of a bad faith business:

Fraudulent activities and misstatements

Diversion of funds equal to Rs 3,535 crore from 7 subsidiaries to a promoter entity (Mysore Amalgamated Ltd.)

Diversion of funds to the amount of Rs 130 crore, whose apparent beneficiary being Malavika Hedge - current CEO and wife of V.G. Siddhartha

Collusion of statutory auditors. M/s ASRMP & Co stands debarred for ten years with a fine amounting to Rs 2 crore. The individual auditors have also been fined and debarred.

Debt Burden of Rs 7,200 crores raising a threat of insolvency

Battling lawsuits, fines and defaults

Surviving in an overtly competitive market

Coffee bean prices hit a 13-year low in 2019, the pandemic was another crucible

In the four years since V.G.S.'s passing, the board has been the sturdy anchor, ensuring the ship stays on course.

Crown of Thorns; Change of Leadership

In 2008 after an eight-year hiatus, Howard Shultz, the founder of Starbucks, returned as CEO to align the business operations and take charge of the situation. While the previous leadership justified the hike in product prices attributing them to the economy and the rise in cost of raw materials, Shultz chose to focus on the various internal strategic problems. He centred his attention towards employees and retained the core values of the brand, which had taken a back seat with their rapid expansion.

His voicemail to partners explained the future course, “In refocusing our company, we are going to play to our strengths to what has made Starbucks and the Starbucks experience so unique; ethically sourcing and roasting the highest quality coffee in the world, the relentless focus on our customers, the trust we have built with our people, and the smart, entrepreneurial risk-taking, innovation and creativity that are the hallmarks of our company.”

In 2019, Coffee Day Enterprise Limited underwent a strategic shuffle, appointing ex-chief secretary of Karnataka S.V. Ranganath as the interim chairman and Nitin Bagmane - an early investor as the chief operating officer of the newly formed executive committee.

Malavika Hedge took over the reins in December 2020 as the CEO of Coffee Day Enterprise Limited, before taking over she addressed their 25000 employees through a heartfelt letter and signalled at efforts towards debt reduction and preserving her husband’s legacy. She wrote, “We will work to reduce the debt to a manageable level by selling a few more investments as I am committed to the company’s future.”

Realigning Company Objectives

Schultz’s strategy focused on improving their product line, refining the Starbucks experience and adopting a tech-driven edge. Schultz reinvested in his employees by taking 10,000 store managers to New Orleans for a four-day conference, turning heads with its extravagant expense.

The conference started with community service, with 54,000 volunteer hours and investing about $1 million in local projects - this made them the single largest block of community support in the history of New Orleans. The vulnerability shown by Schultz, with the transparency of galvanising the top management and starting over instilled a sense of community and responsibility. He then shut down every Starbucks for one afternoon to train their baristas.

Coffee Day Enterprises Limited (CDEL) has had their hands in more than just coffee beans and retail outlets. With 46 subsidiaries in 2019 that were engaged in luxury resorts, logistics solutions, IT parks, brokerage business and many more - they seemed to have lost track of the bigger picture.

Likewise, the core business of Starbucks had suffered substantially owing to its venturing into the entertainment business. They had opened their own recording company that won eight Grammy’s, launched a movie and opened an “entertainment office” in L.A. They exited the entertainment biz. and refocused everything on coffee.

CCD in order to focus on their core business, has reduced its subsidiaries to 17, a 65% reduction as of March 2023. Debt restructuring through asset resolution and closure of unprofitable outlets has been CDELs major strategy, mirroring that of Starbucks.

Trimming the Fat

Closure of unprofitable store

Starbucks had over 16000 stores worldwide including 11,500 stores in the US. They shut around 780 U.S. stores and 61 stores out of a total of 85 in Australia over a period of five years. They laid off 12,000 employees in 2008. The closure led to a reduction in costs by $850 million.

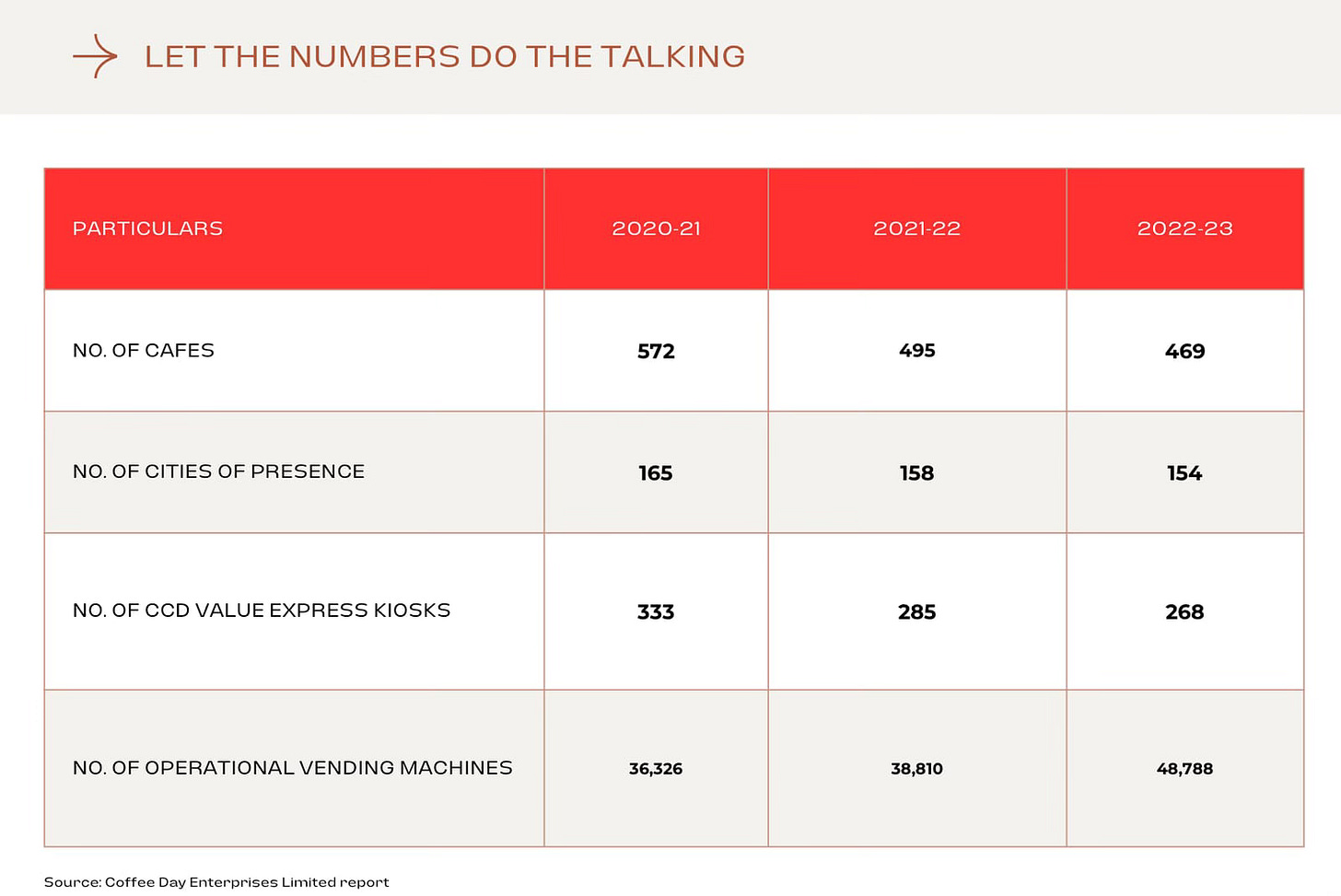

As of now, CCD has closed down its international outlets and has decreased its domestic stores from 1700 to 450, a stone-cold 73% reduction. The number of vending machines sold have increased over the last few years but the kiosks installed have fallen sharply.

Asset resolution

Unlike Starbucks that financially stabilised by closing stores and cutting costs, CCDs liquidity crisis demands asset restructuring.

Pivotal cash injections that have helped Coffee Day Enterprises Ltd sidestep insolvency over the last five years:

CDEL has sold its tech park to Blackstone for Rs 2,700 crore

Sale of stake in Mindtree for Rs 1,800 crore

MACEL, a promoter entity still needs to repay Rs 1,028 crore

CDEL's current debt stands at 434 crore, a promising 94% reduction from 2019.

Product Innovation

Product innovation lies at the heart of every business, Schultz brought back the ritual of grinding coffee in the stores. This was aimed to kick in the sensory experience and establish it as a prime choice to connect and enjoy coffee. They also innovated their product offerings and opened new store formats such as drive-throughs. The experience, menu, products, and digital visibility - all stood refined.

CCD in 2021 introduced its “OMG” menu that offered innovative spins such as Cold velvet coffees, dessert shots, banana cake and more. With healthy options like Lemon green coffee, spiced vegan coffee and a range of 50-plus beverage options with a variety of bites, they cater to all moods and prices. Their newly launched options range from Belgian hot chocolate flavoured with Raisin and rum to a perfect winter warmer named “Mulled spiced winter warmer”. The range has been carefully curated for the season and changes in consumer preferences, but like me if you too haven’t heard of these new offerings from their menu, the real innovation that they still need to ace at is marketing.

Unconventional Media and Marketing Strategies

Schultz realised the power of digital technology back in 2008, making it an important pillar for their turnaround. They leveraged it to garner customer engagement, launch their digital loyalty program and their app.

They then rolled out the “My Starbucks Idea” - a platform for customers to interact directly and suggest ideas to the company on anything and everything. More than 93,000 ideas were exchanged with over 1.3 million users. Starbucks implemented over 100 ideas, which won customer trust. Further, their social media game focused on building and engaging instead of forcing products down users' throats. They created the “cool” persona online and swiftly used it to clear their name from controversies.

By November 2009, My Starbucks Rewards had integrated their loyalty program that started from “Welcome Level” to “Gold Level”, where customers earned freebies and in-store benefits as they frequented the store and levelled up. This was imperial to customer retention and loyalty.

CCD has had loyalty programs for over a decade now, with their major customer falling in the 15-29 age bracket. They have launched social media campaigns such as “CCDSummerscapeChallenge”, which hasn’t garnered traction. An out-of-the-box strategy is what will take to win back the youth.

The Competition

Starbucks faced major competition from the entry of new players in the coffee market, mainly McDonald's and Dunkin Donuts. Caribou Coffee, Peet’s Coffee & Tea Chains were other notable new entrants that gave Starbucks tough competition in 2008. Consumers no longer wanted to pay a premium when a dozen more alternatives had cropped up, with lesser money to spend they chose to settle at these more than just coffee places. To combat this Starbucks added pastries and snacks to complement and stretch the usual coffee routine. They also installed the Clover coffee machines that produced the best coffee Schultz had ever tasted. With campaigns and social media they managed to retain their consumer base.

Cafe Coffee Day meanwhile faces competition from Starbucks itself as of 2024. CCD with 436 outlets still dominates as the biggest coffee chain in India, with Starbucks standing second with 350 stores. International coffee giants such as Tim Hortons, Costa Coffee, Pret A Manger are expanding their roots in the Indian market, while brands like Lavasa are also set to make a comeback in India. Meanwhile, the local coffee houses and startups such as Blue Tokai and Third Wave Coffee are gaining popularity at a rapid pace.

CCD needs to buck up and find innovative ideas to stay put in the market before it is too late.

Government Ties

“Many shall be restored that now are fallen and many shall fall that now are in honour.” - Benjamin Graham

V.G. Siddhartha’s untimely demise brought to light the pressures from the government, taxation departments and lenders which led to him feeling harassed and pushed into a corner. Fast forward to 2024, V.G. Siddhartha’s son is married to the daughter of DK Shivakumar, the Karnataka Congress chief, while Malavika Hedge is the daughter of the ex-chief minister of Karnataka who held office from 2009 to 2014. With Congress taking over in the 2023 Karnataka election, the stock prices rose by 17%.

Technical Analysis

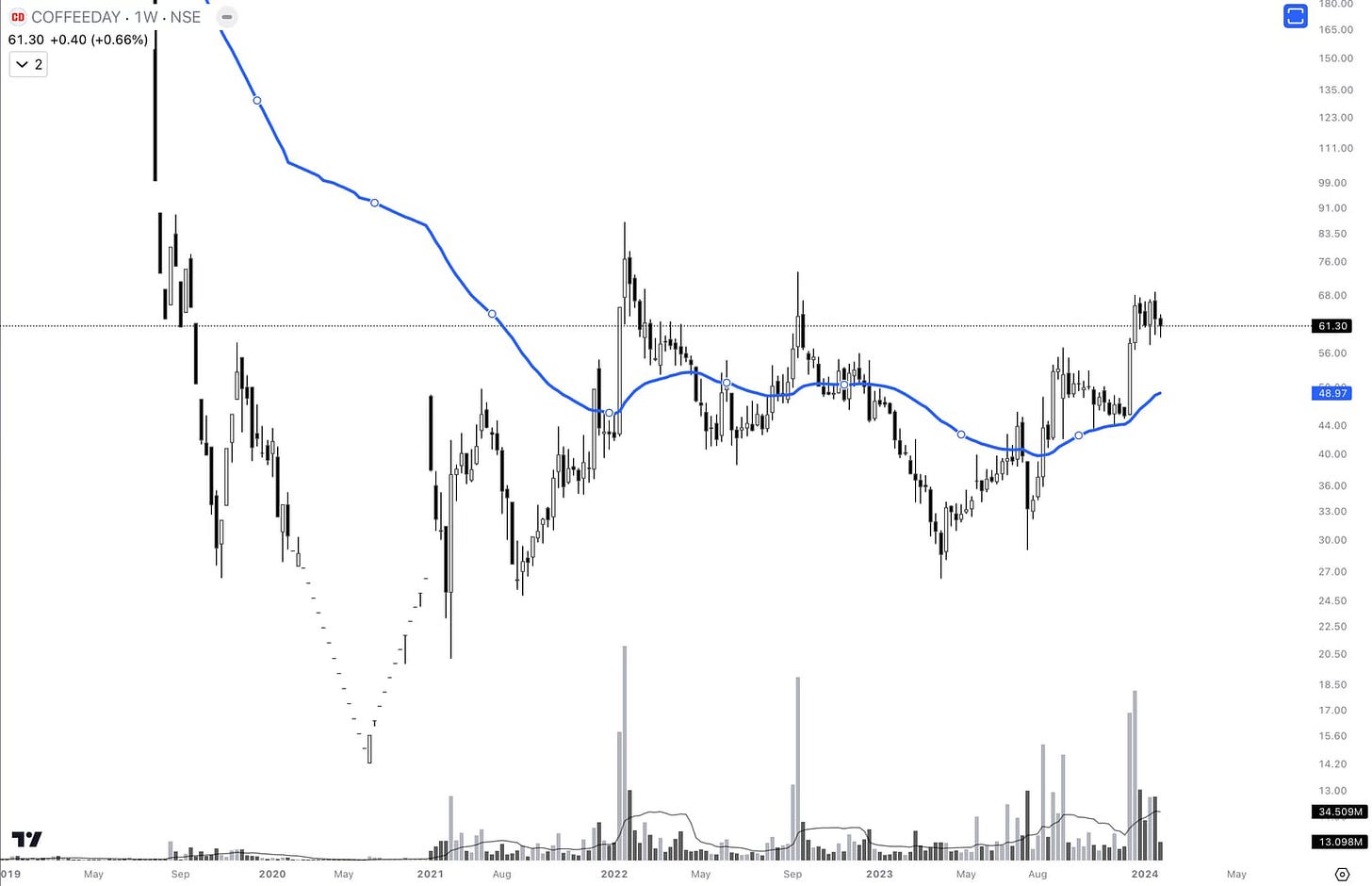

The Starbucks stock price fell far more gradually than Coffee Day Enterprises, which experienced a rapid and relentless fall. But the charts are strikingly similar in that they both have clearly defined double bottom structure on the daily and weekly timeframes.

While Starbucks had a consistent HH/HL stair-stepping pattern after the bottoms that was largely above the stock’s 200 day moving average, Coffee Day Enterprises has only just broken to the upside from its 200 DMA in August. The break comes with very high volume and looks promising, although the price faces a cluster of resistance from 66-86. Once we’re past this, there’s no structural resistance till about 200 levels. Of course, earnings will have to turn positive for valuations to catch up to the price first.

Present Day Scenario - A Summary

CDEL has formed partnerships with New World Hospitality based in Hong Kong, for working together to run operations and open new world properties in India. The glimmer of hope also shines on their vast coffee estates spanning 20,000 acres that produce the finest Arabica coffee beans; they've leveraged it to accelerate their vision.

Even while oscillating between resilience and uncertainty they've managed to churn out Rs.869 crore as revenue from their retail business in FY 2022-23. With their total debt slashed by approximately 95% and revenue grown by 15% year-on-year in FY 2022-2023, they have made an impressive comeback.

With Starbucks' successful rebound as inspiration and strategies borrowed from the past, CCD is striving to write a new script. Yet, amidst fines, creditors and competitors amping up, can they caffeinate their future flights, or will they run out of steam?

In this coffee conquest, there's always another cup waiting to be served, will yours be from CCD?