The Barter Myth: Busted! How Money Really Evolved

A cow for a cloth, a hen for a handful of grain - ring a bell? It's all part of the fairy tale we’ve been fed. Pure fiction or mass manipulation, you decide.

Meanwhile, let's explore the true history behind where money came from and why our textbooks got away with churning this narrative for years. Barter; the backbone of economics has no crutch to stand on, unless you consider make-believe a good enough reason.

There's no anthropological evidence to support the idea that entire economies revolved around barter.

But how did this myth spread like wildfire?

A lie continually told with conviction, ended up eclipsing the truth.

Adam Smith, the author of ‘The Wealth of Nations’ fanned the flames of Aristotle’s conjecture. He penned it down even though Aristotle had admitted that it was pure speculation. Further, W. Stanley in his popular book ‘Money and the Mechanism of Exchange’ took the liberty of taking his examples straight from Smith’s book.

So, where did money come from?

Money seems to have emerged alongside the development of writing, likely created to keep track of transactions and debt.

Even though we still do not have a consensus on its origins, all evidence suggests that non-metal money was rooted in debt and scarcity. Money was a social construct from the beginning, what was of ‘value’ was collectively decided and traded and most likely was a scarce resource.

For example, in Ethiopia people used Salt bars, their scarcity made them of value. Surprisingly, Rai Stones in Yap led to the establishment of a primitive ledger system, where they owed each other fractions of the very heavy, nearly immovable Yap stones. They were as hard as mining gold and equally scarce. While in other places like West Africa the Cowrie shells were debased by the Europeans, which further led to a cascading effect of slave trades and forceful land acquisitions.

Tribes used to exchange their resources on an understanding of ‘I-owe-you’. A hunter shared his find for a favour owed in the future. Economies operated without money, but very well through the existence of debt and gift-giving.

Social relationships and mutual credit understanding were the backbone that carried economies, not the imaginary spot transactions of ‘15 cows for yards of cloth’.

From Debts to Shekels: The Rise of Early Monetary Systems

Around 5,500 years ago, agricultural societies in Mesopotamia and Egypt developed systems based on debt. For example, the silver shekel was used as a unit of currency in Mesopotamia. People used these lumps of metal to pay taxes or buy goods on credit.

The first coins, stamped with images to guarantee their value, appeared around 2,600 years ago in Lydia, now part of Turkey. Coins quickly spread throughout the region and became the preferred form of currency for many societies.

A Quick Timeline of the Evolution of Money:

Commodity Money: From Bullion to Paper

Over time, people started using scarce resources like metals as a form of currency. This eventually led to the development of paper money.

Metal Money: A Range of Forms

Throughout history, different cultures have used various metals like bronze, copper, and even gold as a form of currency. Bronze Spade in China, Copper Plate in Sweden and Aes Rude (bronze) in Rome are some of the first forms of metal money.

Minted Money: The Rise of Coins

Coins weren't always around. They actually came about much later, around 2500 years ago. Funding wars and armies by using coins led to it becoming legal tender.

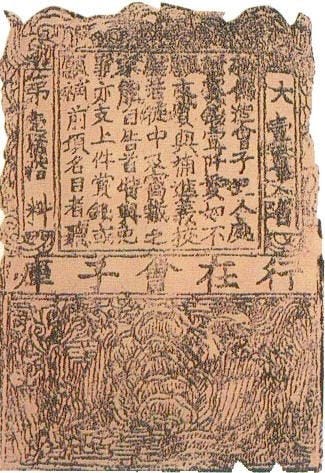

Paper Money: A Solution to Gold Shortages

Paper money was invented to address a lack of gold to back up existing currencies and for its ease of use. Warehouse receipts in China known as Jiaozi Promissory Note were the first paper money issued for commodities (say grain or gold).

Private Bank Notes

Goldsmiths were the early bankers succeeding whom the private banks issued their own notes which were their own liability in terms of circulation and trading.

Commercial Banks

Governments took charge of the banking systems, making them the top ledgers and commercial banks acted as a form of sub-ledgers.

Plastic Currency

Much later in the 20th century, debit and credit cards became the preferential payment mode.

Digital Cash

Leaping into 1982, David Chaum introduced the idea of “Blind Signatures and Untraceable Payments” in his paper, and ran his company DigiCash on this idea. After 9 years, his company went bust like many others that tried to replicate him, up until Bitcoin. He is also known as the godfather of cryptocurrency.

Cryptocurrency

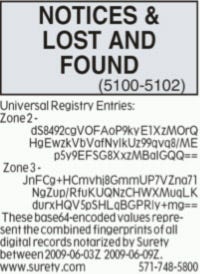

Stuart Haber in the early 90s used hash functions for their company Surety. Once a week they published in The New York Times, using the newspaper as a timestamp for that week’s information.

Bitcoin

In 2008, Satoshi Nakamoto published a paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” A decentralised transaction ledger, that solved the double spending problem. The rest is history.

The Takeaway: Rethinking the Origins of Money

The question of whether debt or money came first is an everlasting debate between economists and anthropologists. While many economists believe that bartering led to the creation of money, anthropological evidence suggests that debt played a more significant role.

Interestingly, research by anthropologists like Michael Hudson, Cornelia Lunch, and David Graeber suggests that gift-giving and credit systems were more common in pre-monetary societies. These systems fostered social ties and economic cooperation.

The story of barter may be a myth, but that doesn't make history any less interesting. The evolution of money is a fascinating tale of human creativity and adaptation. So, the next time you think about money, remember – it all started with keeping track of debts and building trust within societies.

Fin.

Just amazing, more power to you ✨💯

Great way of coagulating factual imprints from ages to the present era, don’t mean to complicate things but indeed I connected with a conclusion, i.e., “mera Paisa kab degi”.:-)